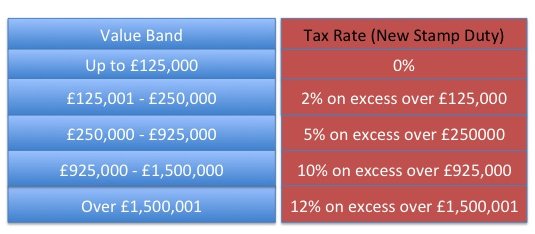

The new rules in respect of Stamp Duty start on 4 December 2014.

For example if you buy a property for £300,000, you’ll pay £5,000 of SDLT. This is made up of:

- nothing on the first £125,000

- £2,500 on the next £125,000

- £2,500 on the remaining £50,000

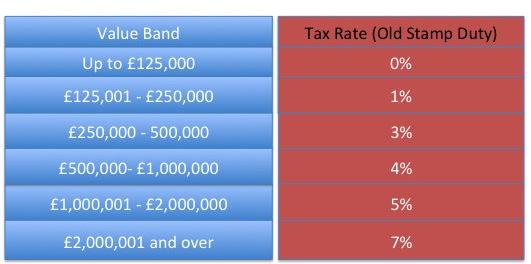

In this scenario the reform will save you £4,000 if compared to the old Stamp Duty rates.

The reform was claimed to benefit first-time buyers and low and middle-income families, but there are thoughts that these changes might be reflected in house prices in the long run due to the growing demand. The increase in a property price might be also caused by the fact that this scaling tax system may encourage vendors took advantage of the tax cut by pushing prices slightly up.

Corporate bodies

SDLT is charged at 15% on residential properties costing more than £500,000 bought by bodies like:

- companies

- collective investment schemes

There are some exceptions. For example, you pay SDLT based on the new rates and bands where the property is used for:

- a property rental business

- a property development or resale trade

- providing admission to visitors on a commercial basis